Technical analysis in forex trading is a method in which we understand and predict market price movements based on past data.

The main objective of this method is to predict future price direction by analysing price charts.

In this blog, we will learn:

- What is technical analysis

- What are the basic tools and indicators

- How can you use them in your trading

What is technical analysis?

- The study of price charts, volume data, and historical price patterns is what we do in technical analysis.

- Understands price trends and market psychology

- Tries to predict future price movements

📊 Types of Price Charts

There are 2 types of charts commonly used in Forex:

1. Line Chart

- Simple Chart

- Connects nearby prices with a line

- Basic for understanding trends

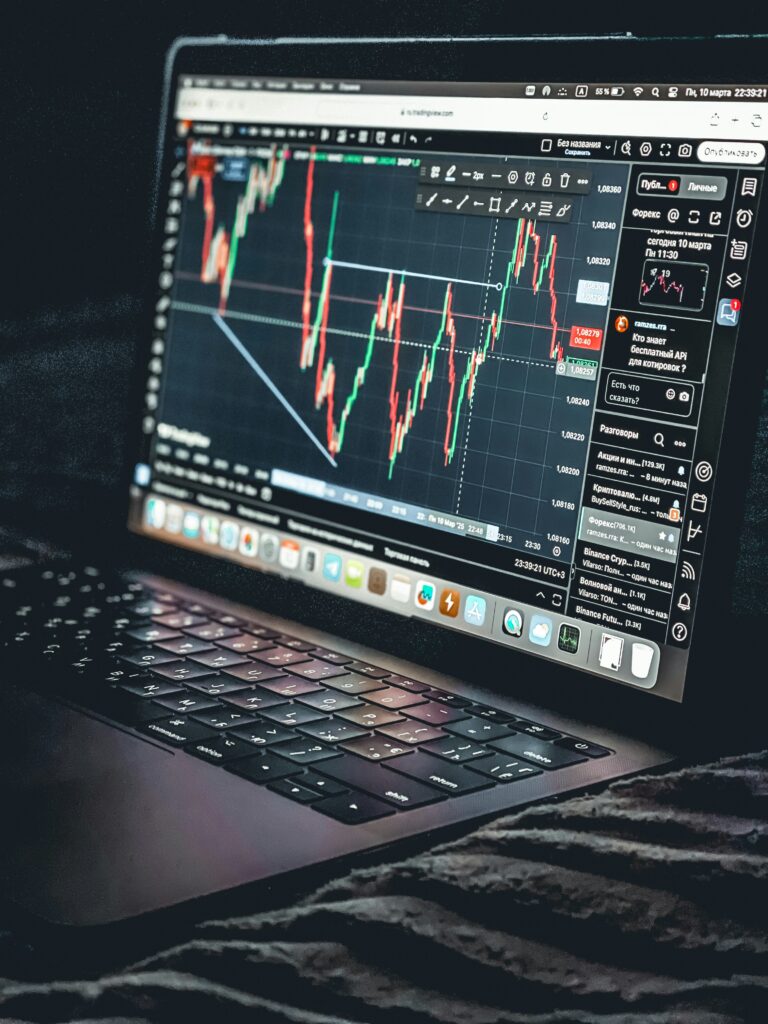

2. Candlestick Chart

- Most popular chart

- Shows the open, high, low, and close price of candles

- Shows easy-to-read patterns

- Candlestick patterns signal trend reversals or continuations

Basic Technical Analysis Tools

1. Trend Lines

- Simple straight lines connecting support and resistance

- Used to identify trends

2. Support and Resistance

- Support: Price levels where buying pressure occurs

- Resistance: Price levels where selling pressure occurs

- Price stops or reverses at these levels

3. Moving Average (MA)

- Average of past price data Goes

- Helps understand the direction and strength of the trend

- Common types: Simple MA, Exponential MA

4. Relative Strength Index (RSI)

- Momentum indicator

- On a scale of 0-100

- 70+ = Overbought (sell signal)

- 30- = Oversold (buy signal)

5. MACD (Moving Average Convergence Divergence)

- Detects both trend and momentum

- Signal line crosses give buy/sell signals

How to use technical analysis?

Step 1: Identify the market trend

- The market’s uptrend, downtrend, or sideways trend can be determined by using trend lines and moving averages

Step 2: Mark support and resistance levels

- Monitor price action at these levels

- Wait for a breakout or reversal signal

Step 3: Check indicators

- Get confirmation from indicators like RSI, MACD

- Is the market overbought or oversold?

Step 4: Determine entry and exit points

- Create a trade plan based on chart patterns, candlestick signals, and indicators.

Popular Candlestick Patterns

| Pattern Name | Meaning | Use |

| Doji | Market indecision | Trend reversal signal |

| Hammer | Bullish reversal after downtrend | Buy signal |

| Shooting Star | Bearish reversal after uptrend | Sell signal |

| Engulfing Pattern | Strong reversal indication | Entry or exit signal |

Trading Example Using Technical Analysis

EUR/USD is in an uptrend (confirmed by MA)

Price has reached support

RSI has given an oversold signal

Doji candle has formed

→ Buy Trade Setup

Place Stop Loss slightly below Support, Target Resistance Level.

For the best Technical Analysis Platform –https://www.tradingview.com

FaQ:

Question 1. Is technical analysis 100% accurate?

Answer: No, the market is unpredictable. Use with risk management.

Question 2. How many indicators should be used together?

Answer: 2-3 indicators are best, using more increases confusion.

Conclusion

Technical analysis is a powerful tool in forex trading that helps you understand the direction of the market and make good trading decisions.

But always remember that it does not provide a 100% guarantee, so risk management is very important.

So if you liked this blog then follow and share www.growthlikej.com for similar informative knowledge blogs.